- Home

- Your Credit

- Fico Credit Score Range

FICO Credit Score Range: What’s A Good Credit Score?

The FICO credit score range can be very confusing. Credit scores are one of the most critical elements of personal finance, but understanding what your credit file says about you can be very confusing.

Your score can enrich your lifestyle and open doors of opportunity or hold you back from realizing some of your biggest dreams.

Before you can make your credit score work for you, there are three essential questions to answer, including:

- What is a good credit score?

- Where does your credit score stand today?

- How can you build a good credit score?

This quick guide will help you answer those questions. You’re one step closer to getting the good credit score you deserve.

Learn How to Check Your Credit Scores, Today!

If you haven’t already, now is the time to check your credit scores. Maybe you already have copies of your three credit reports, but your scores are equally important, and you can’t get free credit scores as you do free annual credit reports.

But there are a few options to consider:

- Check your credit score for free using Credit Karma, Credit Sesame, or other online services. You can monitor your credit scores over time while catching changes to your credit reports quickly. These sites use VantageScores and should give you a good idea of your credit scores for at least two of the three credit bureaus.

- Sign up for a paid MyFICO service to monitor your FICO scores and credit reports quarterly or monthly. This reputable service will provide identity theft insurance and notifications when something changes on one or more of your credit reports.

- Check your credit card statements and banking apps to see if you have access to free credit score checks. Many financial institutions now offer monthly or quarterly scores to help customers manage their credit scores easier.

- Pay to check your scores one time through any credit reporting bureaus. Each credit agency will have its FICO score, so you need to check all three to see where you stand today.

VantageScore vs. FICO Scores.

Did you notice that the options listed above give you access to different credit scores? It’s easy to get confused here.

But the following pointers will make credit scores more understandable:

- Credit scores are generated by software designed to process sophisticated credit scoring models. A variety of data is put into the software to generate your credit score based on the information provided in your credit report.

- There are two companies currently providing official credit scores: VantageScore and FICO. They both use their software and place different weights on each factor that feeds into your credit scores so that they can generate different scores based on the same credit report.

- Each credit score agency can create multiple scores for every consumer. There are currently 28 FICO scores that lenders may use. Each score is calculated with a different algorithm to help lenders decide on the type of loan or line of credit they want to secure. Other scores are general representations of your past financial behavior.

- Most financial institutions and lenders use FICO scores.

- There’s no way to check your FICO scores for free unless that service is part of a credit card, credit union, or bank that you already use. Your VantageScores are available through free services like Credit Karma, but those scores don’t precisely match the FICO scores most likely used by lenders.

We’ll go into more detail on the different credit scores available today and how to check your credit scores without impacting your credit on other pages on this website.

For now, you should have a general understanding of the two credit score providers and what makes them different. You have the knowledge you need to check your credit score and determine if it’s good or even excellent.

What Is An Excellent Credit Score?

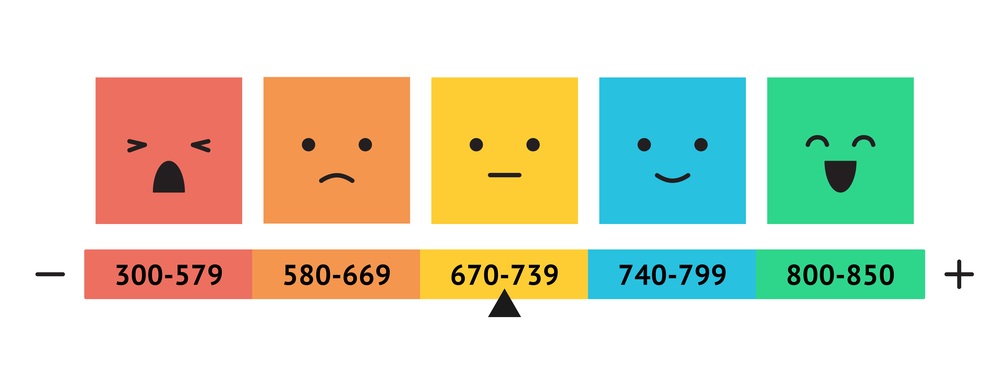

When analyzing your credit scores, assume we’re talking about the FICO credit score range or VantageScores 3.0 or 4.0. Some earlier versions of VantageScore used a different number range than FICO, but these latest versions use the same range of 300 to 850.

If your base FICO credit score range is 800 or above, you have excellent or exceptional credit. 780 or higher is considered perfect for a VantageScore.

Less than 2% of all consumers have a perfect credit score of 850. The 800+ club is less exclusive, but you still need to work hard to establish various credit types while carrying low balances if you want to get there.

What Is a Good FICO Credit Score Range?

670-739 is considered a good FICO credit score range for FICO credit scores, and 740-799 is an excellent FICO credit score range. For VantageScores, 661-780 is good.

In general, any score over 700 is good regardless of the type of score checked. Many lenders will feel most comfortable offering low-interest rates and accepting lower down payments from consumers with a score of 700 or higher.

What Is A Fair FICO Credit Score Range?

When your VantageScore hits 600 or your FICO score drops below 670, you no longer have a good credit score. You may face demands for higher down payments or receive more credit and loan denials.

Lenders are likely to give you higher interest rates when accepted because they assume more risk when lending you money.

Why is more risk assumed when you no longer have a good credit score? It comes down to the data used to generate your credit scores. It would be best to have some blemishes on your credit report to have fair or poor credit. That may include car repossessions, bankruptcy, collections accounts, or closed credit cards.

It’s Never Too Late to Build a Good Credit Score!

Past behavior is all lenders have to go on when guessing how likely you are to default on a loan or not pay a credit card bill on time. If your current record is less than trustworthy, now is the perfect time to create a new history.

Today could become the first day in your renewed credit history when you wake up tomorrow. If your FICO credit score range is lower than you would like, the sooner you start the credit repair process, the better.

You can see much stronger credit scores in the next three to six months, if you take a two-pronged approach:

- Change your financial behaviors and patterns. Whether you’re over your head in credit card payments and can’t keep up, or you just haven’t paid much attention to your credit utilization ratio, now is the time to identify and change problems that damage your credit.

- Invest time in credit repair tasks like disputing inaccuracies on your credit reports. Some quick fixes may boost your scores while you work on adjusting your financial habits.

It would be best if you had a basic understanding of what a good FICO credit score range is at this point. FICO and VantageScore update their credit scoring models over time, adjusting to represent changes in patterns and trends seen in the financial industry.

Their goal is to supply lenders with accurate, timely information to predict your creditworthiness. They’re more on the lenders’ side than yours, but that doesn’t mean you can’t play the credit score game and win.

If you don’t have a good credit score now, don’t stress over it. Just start taking steps to give it a boost and keep it as high as possible.

Free 5-Day - Start Repairing Credit Challenge - Do It Yourself - Including A Live Expert Question & Answer Session.

Related Articles:

- How to Start Repairing Credit

- Credit Score Ranges Explained in Terms That You Can Understand

- Credit Repair Shouldn't Cost a Fortune!

- Better Credit Booster News and Tips

- 101 Credit Tips to Boost Credit Score Points, Today!

- Frequently Asked Credit Repair Questions and Answers (FAQ)