- Home

- Boost Credit

- Hacks to Boost Credit Score

Hacks To Boost Credit Score - 8 Techniques Anyone Can Easily Master!

Hacks to boost credit score 101, many people have made financial mistakes in the past that have, in one way or another, hurt their credit score.

Even if you have never made bad credit decisions, you would still want to improve your credit score. Regardless of how high or low your FICO score is, you can continuously improve if you follow the proper steps.

A good credit score is vital for several reasons. Many companies, like insurance companies, lenders, landlords, employers, and utility providers, rely on your credit score and credit information to determine if you are worth doing business with and gauge your reliability.

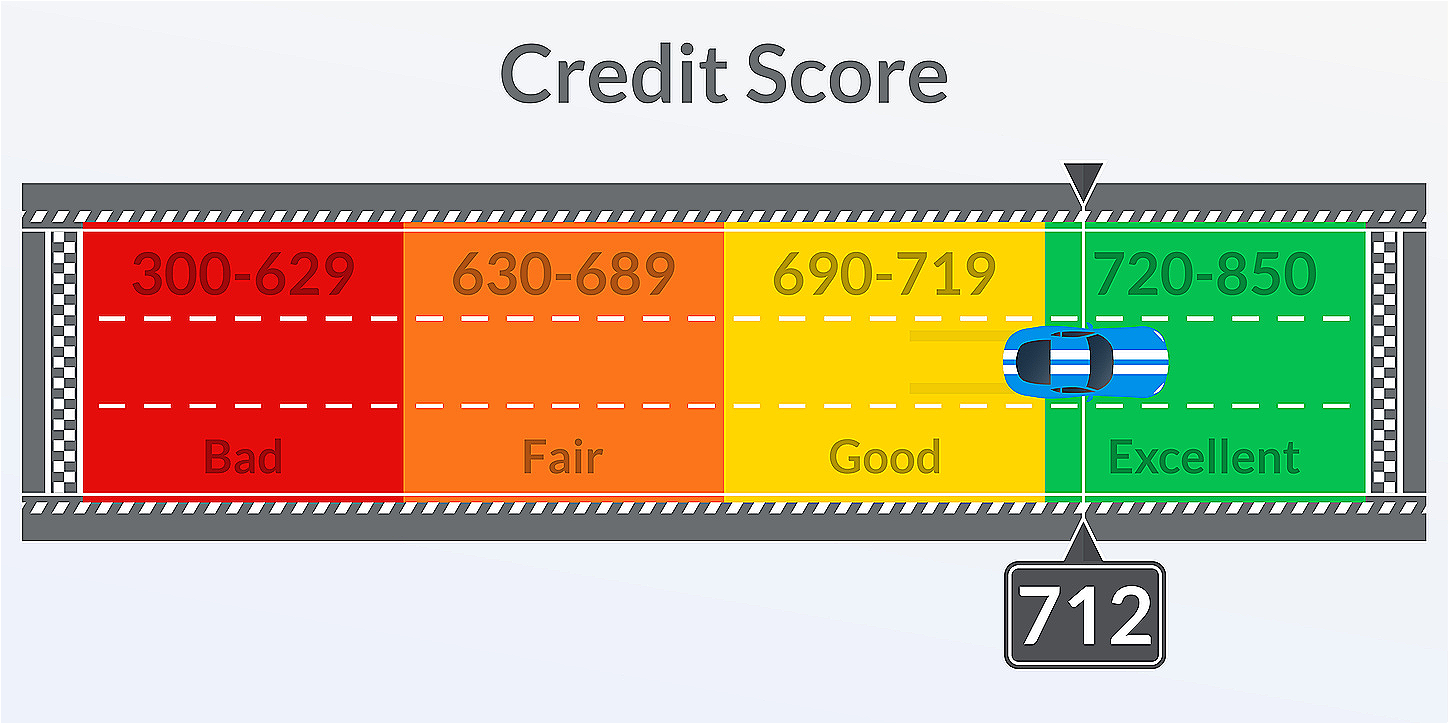

Having a high FICO score is a good thing, and improving it is even better. Typically, credit scores range from 300 to 850, and unless your credit score is at 850, there is always room for improvement.

Here are some credit repair hacks to boost credit score fast.

1. Make Timely Bill Payments

One of the easiest hacks to boost credit score is to pay all bills and debts on time. The attractiveness of your credit score relies heavily on making timely payments for all your accounts.

According to credit experts, your history of bill payments accounts for 35% of your credit score. These numbers demonstrate just how much of an impact paying your bills on time has on your credit score.

If your credit report depicts a history of late payments, the first step to redemption is to establish a record of timely bill payments.

Do you have a habit of forgetting to pay utility bills and other payments on time? Don't fret; it's never too late. Start paying your bills on time. It is one of the most straightforward credit repair hacks to boost credit scores.

2. Scan Your Credit Report For Negative Information And Dispute It

Credit.com discovered that about 21% of Americans' credit reports had negative or incorrect information in a survey done. Whether it is a case of mistaken identity, wrong social security number, or address, many errors could appear on your credit report.

Disputing wrong information on your credit report isn't something you can do overnight, and it will take some time, but once you rid your credit report of the errors, your credit score should improve.

It would help if you prepared yourself for unexpected credit score fluctuations until the errors are corrected. It would be best if you considered disputing any wrong information on your credit report as a hack to boost your credit score.

You can opt for the do-it-yourself method or seek the services of a credit repair company. Credit experts recommend using the advanced dispute method to eliminate your report's negative items if you opt for the DIY approach.

If DIY isn't an option, contact a reliable credit repair company. Although you will have to cough up a few dollars to procure their services, the whole process will be much faster.

3. Try Paying Off Your Credit Card As Early As Possible And Lower Your Credit Utilization Ratio

If you have an excellent history of on-time payments but your credit score isn't improving, consider paying off your credit card debt as early as possible. Your total credit accounts for about 30% of your credit score.

The ratio of your credit balance to your available credit limit is known as your credit utilization. Your credit balance should not be more than 25-30% of your available credit limit. You will notice an improvement in your credit score if you keep your credit utilization under 30%.

Decreasing your utilization score is one of several hacks to boost your credit score. Keep reading for more accessible and exciting tips.

4. Pay Your Credit Card Debt Every Two Weeks

Paying your credit card debts every fortnight is one of many hacks to boost credit score.

You risk inflating your utilization score by putting all your expenses on one card or making a single large purchase. If you pay your credit card debt every fortnight, you will raise your credit score and, in the process, reduce your utilization ratio.

You are bound to get reduced interest rates by making frequent payments. You stand to qualify for better balance transfer offers and better interest rates by increasing your score.

5. Request Your Creditor For An Increase In Your Credit Limit

A good (low) utilization ratio coupled with an excellent payment history are incredible hacks to boost credit score fast. And that's precisely why you should request your creditor to increase your credit limit.

Having your credit limit increased automatically increases your credit utilization ratio; this is how increasing your credit line works to improve your credit score.

Imagine a scenario where you have a $500 credit card limit and a $250 credit card balance; this would mean that your credit utilization is 50%. If you were to increase your credit line from $500 to $1000 and maintain your balance at $250, your utilization would decrease to 25%.

However, credit experts strongly recommend that you only request a credit limit increase if you are confident you won't use it; otherwise, it will be counterproductive and hurt your FICO score.

6. Mix Up Your Credit Lines

Mix-up credit line accounts for about 10% of your credit score, which is suitable for your credit score. For example, you are more likely to achieve a higher credit score if you have a mortgage loan on your report.

Because a mortgage loan gives the lender the impression that you are creditworthy, for this reason, they are willing to lend you a considerable amount. You should get it if you can afford a mortgage because it can positively impact your credit score and overall credit.

7. Avoid Applying For New Credit For A Whole Year

If you don't apply for a new credit line for a whole year, you will have no hard inquiries on your credit report. Having zero incidents of hard inquiries on your credit report means you are not seeking to add another credit line to your name.

Zero hard inquiries can boost your credit score, and hard inquiries on your credit report can stay put for up to 2 years. We recommend that you not apply for new credit lines for this hack to boost credit score for a whole year to boost your credit score.

8. Become An Authorized User On Another's Credit Account

If you have an approachable close friend or family member with excellent credit, ask if they can add you as an authorized user on their account. It will be challenging to get someone willing to add you as an authorized user if you have a bad credit history.

Some individuals may be reluctant to add people to their accounts out of paranoia. While getting paranoid at something like this is highly understandable, the fact remains that they DO NOT have to grant you entry to the account, and you can ask them to hold on to your credit card for peace of mind.

Having someone else make you an authorized user on their account, you benefit from their stellar credit history and everything else that comes with it.

Having an older person willing to add you to their account, like a grandparent or a parent, makes this a good option. It's a good option because your credit history's age makes up about 15% of your credit score. The effect could be immediate because of the massive difference in the age of the accounts.

Hacks To Boost Credit Scores 101

Improving your credit score can prove challenging, especially if you know little about how credit scores work. If getting your credit score numbers up gives you a hard time, you can use these credit repair hacks to boost credit score and watch as your FICO score reaches new heights.

Free 5-Day - Start Repairing Credit Challenge - Do It Yourself - Including A Live Expert Question & Answer Session.

Related Articles:

- 101 Credit Tips to Boost Credit Score Points, Today!

- Credit Repair Shouldn't Cost a Fortune!

- Frequently Asked Credit Repair Questions and Answers- FAQ

- Better Credit Booster News and Tips