How To Freeze Credit Reports - Don't Fall Victim To Identity Theft!

Learn how to freeze credit reports on a budget. Because identity theft can be a nightmare, it can be overwhelming the time and effort it may take you to clear yourself. Often, it will cost you a ton of money! Individuals who have had their identities stolen suffer for months, sometimes even years, after it happened.

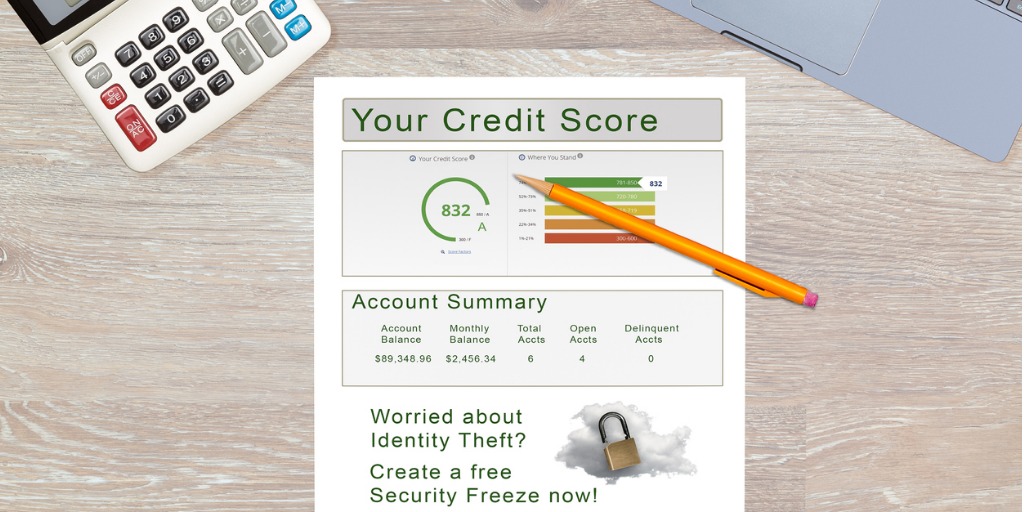

It can even feel like you're doing time for a crime you never committed. If you have noticed any signs of identity theft, consider freezing your credit to act as a shield against identity theft. If you have already fallen victim to identity thieves, you can freeze your credit to prevent further damage.

How To Freeze Credit Reports and What Is A Credit Freeze?

This article will explain everything you need to know regarding how to freeze credit reports.

A credit freeze is a tool/feature of sorts that enables you to prevent unauthorized access to your credit reports. This restriction makes it very difficult for fraudsters to use your personal information to open new credit accounts.

Before extending credit or approving a new account, most lenders ask to access your credit. You limit others, including lenders, from viewing your credit reports when you freeze your credit.

Even when you know how to freeze credit reports, the process can be daunting and costly, not to mention that you will need to approach it as a lifelong commitment. After all, cybercriminals and credit card fraudsters are not going away anytime soon.

Are you considering freezing your credit reports? If so, opt to work with an experienced and professional credit repair expert. A professional can guide you through the credit freeze process from start to finish. And even help you decide if freezing your credit reports is the best way forward.

Credit Freeze Red Flags You Need To Monitor!

If you find yourself dealing with any of the situations below, put some serious consideration into freezing your credit.

- You have fallen victim to identity thieves

- Your credit card is stolen

- Someone has stolen or tampered or messed around with your mail

- You feel the need to safeguard yourself from identity thieves

- You have paid for a credit monitoring subscription

What Are The Effects Of A Credit Freeze On My Credit Score?

Freezing your credit reports with the three credit reporting agencies will not affect your credit score in any way.

In addition to having zero effects on your credit score, freezing your credit cannot:

- Shut you out from securing another account, although you will have to lift the freeze briefly.

- Keep you from receiving your yearly reports.

- Shut you out from getting insurance, making a job application, or leasing an apartment.

- Prevent identity thieves from fraudulently using your existing accounts.

It would be best if you were on the lookout for fraudulent activities by monitoring all insurance, bank, and credit card statements.

Who Can View My Credit Report After I Have Frozen It?

Some entities will be able to access your credit information even after you put a security freeze. After you learn how to freeze credit reports and go through with them, the only people who can access your information include government agencies, current lenders, and debt collectors.

Lenders can demand to see your reports, and debt collection agencies representing your creditor can access your information. Also, a search warrant, a subpoena, an administrative order, or a court order can grant government agencies access to your reports.

Freezing Your Credit Report at Equifax, TransUnion, and Experian.

You can get all the information about credit freezes by visiting TransUnion, Experian, and Equifax websites. Additionally, you can call 1-800-685-1111, 1-888-397-3742, and 1-888-909-8872 to get in touch with Equifax, Experian, and TransUnion, respectively.

Residents of New York can reach Equifax at 1-800-349-9960. You will get adequate information on how to freeze credit reports from the mentioned sources.

Sometimes, credit reporting agencies face web traffic and high call volumes, especially after extensive data infringement and identity theft. The bureau may put you on wait for very long. Online services may also slow down significantly, making it challenging to get online credit freeze forms.

Use certified mail to request a credit freeze via mail. In your credit freeze request, include the following information:

- Complete name, including generational suffixes and middle initials, if any.

- Your full present-day address. Also, include former addresses that go back two years.

- Birthday, birth month, and birth year

- Social security number

- Documents that prove your identity, like a valid copy of your birth certificate, passport, military I.D., or driver's license.

- Information can be used to verify your address, like telephone bills or a utility bill.

- Your payment method

Learn How To Freeze Credit Reports And Not Fall Victim!

A credit freeze will remain active unless you need it to be lifted temporarily or removed for good. If you make an online request for a credit freeze by phone, the bureau must remove the freeze in an hour. If you send your credit freeze request via mail, the freeze must be lifted within three business days.

You can decide to briefly lift your credit at a particular credit agency instead of all three and save yourself a lot of time. You have to be applying for a job or credit and know which bureau will be contacted for your reports. If not, you need to request TransUnion, Equifax, and Experian.

How Does A Fraud Alert Differ From A Credit Freeze?

A credit freeze restricts access to your credit information. On the other hand, a fraud alert permits lenders to acquire your report duplicates, provided they take the initiative to confirm your identity.

Documents Every Victim Of Identity Theft Should Have To Freeze Their Credit Reports!

In nearly all the states, you are not required to pay for freezing or unfreezing your credit report if identity thieves have stolen your identity.

Any victim of Identity Theft can prove that their identities have been stolen by providing a DMV report, a police report (copy), or an identity theft report.

You should not expect to get your documents back once you send them. For this reason, only send copies of the original documents.

Once the credit agency gets your freeze request, they will send a confirmation along with a PIN for freezing and unfreezing your reports.

When and How to Freeze Credit Reports: Advantages and Disadvantages!

Freezing your credit report can be beneficial or detrimental. So consider your options before you decide how to proceed.

Benefits of A Credit Freeze:

- Fraudsters will be unable to use your information to open other credit accounts

- If you had already fallen victim to fraudsters, a credit freeze would minimize the chances of fraudsters using your data

- It does not affect your credit score

- It is free

Drawbacks Of A Credit freeze:

- Activating a credit freeze can be exhausting because it requires you to contact Experian, TransUnion, and Equifax.

- You may forget your PINs (personal identification numbers) required for freezing and lifting your credit.

- You'll have to raise the credit freeze for new lenders temporarily.

- Fraudsters can still access your existing accounts.

Remember, a credit freeze does not apply to your current lenders, and your present-day creditors can still view your reports.

How To Freeze Credit Reports And State Laws

The majority of the states in the U.S. have laws that require credit bureaus to allow credit freezes. However, Ohio, Georgia, Iowa, Missouri, Alabama, Alaska, Michigan, and Virginia do not support these laws. Experian, Equifax, and TransUnion allow credit freezing on a consumer's volition for the mentioned states.

The credit freeze will remain active in most states unless you do away with it, and a security freeze will not last longer than seven years in many conditions. You can view your state's credit freeze laws on the official websites for TransUnion, Experian, and Equifax.

Fees for lifting a credit freeze briefly, removing a credit freeze, or replacing a PIN is between $5 and $20. You will not have to pay any credit freeze fees if you have fallen victim to fraudsters. Credit freeze fees for older adults above a certain age are waived in some states.

Although freezing your credit will not guarantee you safety from fraudsters and identity thieves, it is a big step towards protecting your data and credit information. By learning how to freeze credit reports, your mind can be at ease.

Free 5-Day - Start Repairing Credit Challenge - Do It Yourself - Including A Live Expert Question & Answer Session.

Related Articles:

- Top 8 Tips to Raise Your Credit Score!

- Credit Repair Shouldn't Cost a Fortune!

- Is Credit Monitoring Worth It? Don't Be Surprised By Your Credit Score!

- Better Credit Booster News and Tips

- 101 Credit Tips to Boost Credit Score Points, Today!

- Frequently Asked Credit Repair Questions and Answers- FAQ